When discussing compensation, it is essential to grasp the fundamental differences between hourly and yearly wages. An hourly wage is a payment structure where employees are compensated based on the number of hours they work. This model is prevalent in various industries, particularly retail, hospitality, and service sectors.

Image may be NSFW.

Clik here to view.

Employees earning an hourly wage may have variable incomes depending on the weekly hours, which can fluctuate due to overtime, part-time status, or seasonal demand. In contrast, a yearly salary is a fixed amount paid to an employee over a year, regardless of the number of hours worked. This structure is often associated with professional roles and positions requiring a specific education or expertise level.

Understanding these distinctions is crucial for evaluating job offers or considering career changes. For instance, while an hourly wage may seem appealing due to its potential for overtime pay, it can also lead to financial instability if hours are cut or the job is seasonal. Conversely, a salaried position may provide more economic security but entail longer hours without additional pay.

Therefore, when assessing job opportunities, it is vital to consider the wage type and how it aligns with personal financial goals and lifestyle preferences.

Key Takeaways

- Understanding the Basics: Hourly vs. Yearly

- Hourly wages are paid per hour worked, while yearly income is the total amount earned annually.

- Calculating Your Annual Income at an Hour

- To calculate your annual income at an hour, multiply by the number of hours worked per week, then by 52 weeks in a year.

- Factors Affecting Your Annual Income

- Factors such as overtime, bonuses, and benefits can affect your annual income by an hour.

- Budgeting and Financial Planning at an Hour

- Budgeting and financial planning at an hour requires careful consideration of expenses and savings goals.

- Comparing an Hour to National Average Income,

- an hour may be higher or lower than the national average income, depending on location and industry.

- Opportunities for Career Advancement at an Hour

- Career advancement opportunities at an hour may include additional training, certifications, or seeking higher-paying positions.

- Making the Most of Your Hour Salary

- Making the most of an hour’s salary involves smart spending, saving, and investing for the future.

- Tips for Negotiating a Higher Hourly Wage

- Negotiating a higher hourly wage can be achieved by highlighting skills, experience, and value to the employer.

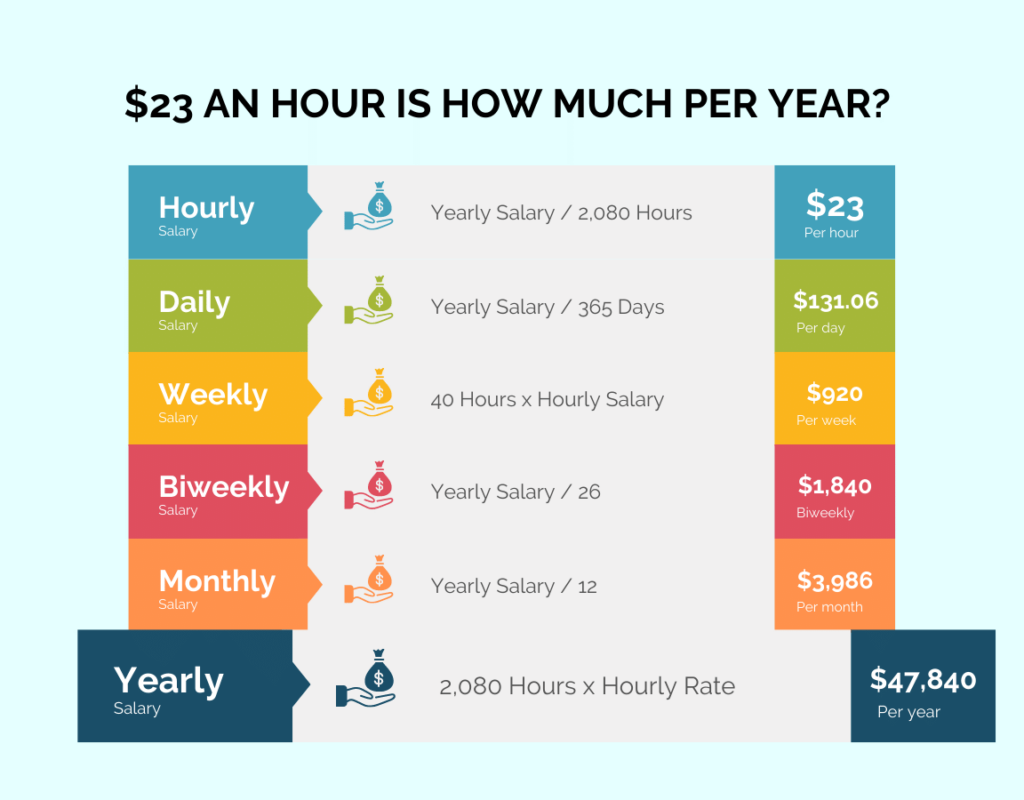

To determine your annual income based on an hourly wage of $23, you first need to establish how many hours you work in a week and how many weeks you work in a year. The calculation is straightforward for a full-time employee working 40 hours per week for 52 weeks. Multiplying the hourly wage by the hours worked weekly gives you a weekly income of $920.

When this figure is multiplied by 52 weeks, the annual income totals $47,840. This figure shows what one can expect to earn in a year if one maintains consistent full-time hours. However, it is important to note that not all jobs offer consistent hours or full-time schedules.

Many individuals may work part-time or have variable hours that can significantly affect their total annual income. For example, if someone works only 30 hours per week instead of 40, their annual income would drop to $35,880. Additionally, factors such as unpaid time off or seasonal fluctuations in work can further impact earnings.

Therefore, while calculating potential income at $23 an hour provides a useful benchmark, individual circumstances and work patterns must be considered when estimating annual earnings.

Factors Affecting Your Annual Income

Several factors can influence an individual’s annual income beyond the hourly wage. One significant factor is the industry in which one works. Different sectors have varying pay scales based on demand for labor, skill requirements, and overall profitability.

For instance, jobs in technology or healthcare may offer higher wages than those in retail or food service, even if the positions require similar education or experience. Additionally, geographic location plays a crucial role; wages can vary significantly from region to region due to differences in the cost of living and local economic conditions. Another critical factor affecting annual income is experience and education level.

Generally, individuals with more years of experience or higher educational qualifications tend to command higher wages. Employers often value specialized skills and knowledge that come with advanced training or degrees, leading to increased earning potential. Furthermore, performance and productivity can also impact income; employees who consistently exceed expectations may receive bonuses or raises that enhance their overall compensation package.

Thus, understanding these factors can help individuals make informed decisions about their career paths and financial planning.

Budgeting and Financial Planning at $23 an Hour

Budgeting effectively on an income of $23 an hour requires careful consideration of fixed and variable expenses. Fixed expenses include rent or mortgage payments, utilities, insurance premiums, and any other costs that remain constant each month. If one earns approximately $3,987 (based on full-time hours) monthly, allocating funds wisely to cover these essential expenses is crucial.

After accounting for fixed costs, individuals can assess their discretionary spending on groceries, entertainment, and savings contributions. Financial planning also involves setting realistic savings goals and preparing for unexpected expenses. With an annual income of around $47,840, saving at least 20% of one’s income for emergencies and future investments is advisable.

This could mean setting aside approximately $800 monthly for savings or retirement accounts. Additionally, individuals should consider creating an emergency fund that covers three to six months’ worth of living expenses to provide a financial cushion in case of job loss or unexpected bills. Individuals earning $23 an hour can achieve greater economic stability and peace of mind by prioritizing budgeting and financial planning.

Comparing $23 an Hour to the National Average Incomes

| Income Level | Annual Income |

|---|---|

| 23 an Hour | 46,800 |

| National Average | 63,179 |

When evaluating an hourly wage of $23 in the context of national average incomes, it becomes evident that this figure falls within a competitive range for many workers across various sectors. According to recent U.S. Bureau of Labor Statistics (BLS) data, the median hourly wage for all occupations hovers around $20 per hour.

This means that earning $23 an hour places an individual above the national average, which can be advantageous when considering job offers or negotiating salaries. However, it is essential to recognize that while $23 an hour may be above average nationally, regional variations can significantly affect its purchasing power. In high-cost areas such as New York City or San Francisco, this wage may not stretch as far as it would in lower-cost regions like rural America.

Therefore, while comparing wages against national averages provides useful context, individuals must also consider local economic conditions and cost-of-living factors when assessing the adequacy of their compensation.

Opportunities for Career Advancement at $23 an Hour

Earning $23 an hour can be a stepping stone toward greater career advancement opportunities. Many entry-level positions that start at this wage often provide pathways for growth within organizations. Employees who demonstrate strong work ethic and commitment may be eligible for promotions or raises after gaining experience and proving their value to employers.

Additionally, many companies offer training programs or tuition reimbursement for further education, allowing employees to enhance their skills and qualifications while still earning a steady income. Networking also plays a crucial role in career advancement at this wage level. Building relationships with colleagues and industry professionals can open doors to new opportunities and provide valuable insights into potential career paths.

Attending workshops, conferences, or industry events can help individuals expand their professional networks while showcasing their skills and ambitions. By actively seeking out opportunities for growth and development within their current roles or through external connections, individuals earning $23 an hour can position themselves for long-term career success.

Making the Most of Your $23 an Hour Salary

Maximizing a $ 23-an-hour salary involves strategic financial management and lifestyle choices that align with personal goals and values. One effective approach is to prioritize essential expenses while minimizing discretionary spending. This might include cooking at home instead of dining out frequently or seeking free community events for entertainment rather than costly outings.

Individuals can stretch their income further by making conscious choices about spending habits while still enjoying life’s pleasures. Additionally, investing in personal development can yield significant returns over time. Pursuing certifications or additional training relevant to one’s field can enhance employability and potentially lead to higher-paying positions.

Online courses and workshops are often available at low costs or even free through various platforms, making it easier than ever to acquire new skills without breaking the bank. Individuals earning $23 an hour can create a fulfilling and financially stable life by focusing on immediate financial management and long-term career growth strategies.

Tips for Negotiating a Higher Hourly Wage

Negotiating a higher hourly wage requires preparation and confidence. One effective strategy is to conduct thorough research on industry standards for similar positions within your geographic area. Understanding what others in comparable roles can provide leverage during negotiations and help justify your request for a raise.

Additionally, compiling evidence of your accomplishments and contributions to the organization can strengthen your case; highlighting specific projects you’ve completed successfully or ways you’ve added value can demonstrate your worth as an employee. Another important aspect of negotiation is timing; approaching your employer during performance reviews or after completing a significant project can increase your chances of receiving a favorable response. Practicing your negotiation skills with friends or mentors beforehand can also help build confidence and refine your approach.

Remember that negotiation is often a dialogue rather than a confrontation; being open to discussion and willing to compromise can lead to mutually beneficial outcomes that enhance earning potential while maintaining positive relationships with your employer.

FAQs

What is the annual salary for someone making $23 per hour?

The annual salary for someone making $23 per hour can be calculated by multiplying the hourly rate by the number of hours worked in a year. For example, if someone works 40 hours per week for 52 weeks, their annual salary would be $23 x 40 x 52.

What is the annual salary for someone working part-time at$23 per hour

If someone works part-time, their yearly salary would be calculated based on the number of hours they work per week and the number of weeks they work in a year. For example, if someone works 20 hours per week for 52 weeks, their annual salary would be $23 x 20 x 52.

Are there any additional factors that could affect the annual salary for someone making $23 per hour?

Additional factors that could affect the annual salary for someone making $23 per hour include overtime pay, bonuses, and any deductions such as taxes and benefits.

What is the average annual salary for someone making $23 per hour?

The average annual salary for someone making $23 per hour would depend on the number of hours worked per week and the number of weeks worked in a year. However, based on a standard 40-hour work week for 52 weeks, the average annual salary would be $23 x 40 x 52.